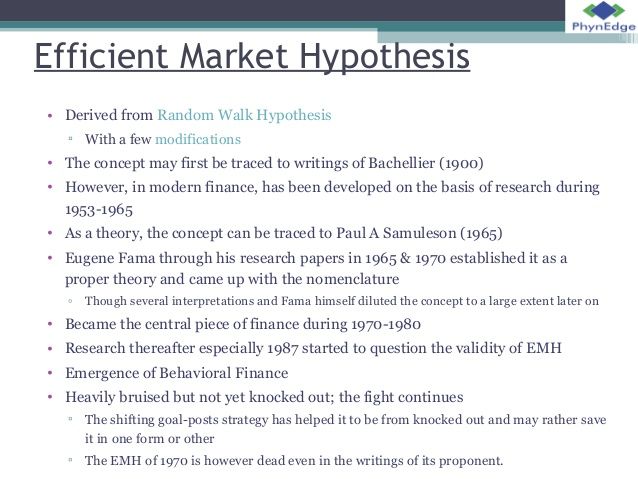

The efficient markets hypothesis EMH popularly known as the Random Walk Theory is the proposition that current stock prices fully reflect available information about the value of the firm and there is no way to earn excess profits more than the market over. Instant industry overview Market sizing forecast key players trends.

Cartoon 42 Efficient Market Hypothesis And Cryptocurrency Prices Efficient Market Hypothesis Cryptocurrency Hypothesis

It was developed independently by Samuelson 1965 and Fama 1963 1965 and in a short time it became a guiding light not only to practitioners but also to academics.

Efficient market hypothesis. Ad Unlimited access to Energy Efficiency market reports on 180 countries. In brief EMH states that in an efficient market stocks incorporate instantly. Neither technical analysis the study of past stock prices in an attempt to predict future prices nor fundamental analysis the study of financial information can help an investor generate returns greater than those of a portfolio of randomly selected stocks.

The efficient market hypothesis holds that when new information comes into the market it is immediately reflected in stock prices. Instant industry overview Market sizing forecast key players trends. Teori Eficiency Market Hipotesis EMH Didalam konsep pasar efisien perubahan harga suatu sekuritas saham di waktu yang lalu tidak dapat digunakan dalam memperkirakan perubahan harga di masa yang akan datang.

The efficient market hypothesis is associated with the idea of a random walk which is a term loosely used in the finance literature to characterize a price series where all subsequent price changes represent random departures from previous prices. The efficient market hypothesis EMH is one of the milestones in the modern financial theory. The ef cient market hypothesis is associated with the idea of a random walk which is a term loosely used in the nance literature to characterize a price series where all subsequent price changes represent random departures from previous.

The logic of the random walk idea is that if the flow of information is unimpeded and. Ad Unlimited access to Energy Efficiency market reports on 180 countries.

My Ebay Active Financial Markets Efficient Market Hypothesis Economic Analysis

What Is The Efficient Market Hypothesis Emh The Poor Swiss Efficient Market Hypothesis Hypothesis Fundamental Analysis

Navigate Money 4 Efficient Market Hypothesis Efficient Market Hypothesis Hypothesis Marketing

Efficient Market Hypothesis Wikipedia The Free Encyclopedia Efficient Market Hypothesis Stock Market Earnings

Efficient Markets Hypothesis Historic Timeline Efficient Market Hypothesis Hypothesis Marketing

Efficient Market Hypothesis Emh Efficient Market Hypothesis Investing Investment Banking

Efficient Market Hypothesis In 2 Easy Steps What Is Efficient Market Hypothesis Lecture Emh Hypothesis Classic Books Efficient Market Hypothesis

Random Walk Efficient Market Hypothesis A Random Walk Down Wall Street Animated A Random Walk Down Wall Street Fundamental Analysis Book Summaries Investing

Efficient Market Hypothesis Efficient Market Hypothesis Hypothesis Marketing

Forms Of The Efficient Market Hypothesis Efficient Market Hypothesis Hypothesis Marketing

Efficient Market Hypothesis Efficient Market Hypothesis Hypothesis Marketing

Pin By Ralph Bennett On Markets Efficient Market Hypothesis Quadratics Market Environment

Efficient Markets Hypothesis Explanation Efficient Market Hypothesis Hypothesis Marketing

Efficient Market Hypothesis Perfect Competition Teaching Economics Efficient Market Hypothesis

Post a Comment

Post a Comment